- Access to Barclays technology, expertise and insights

- Help from Barclays and its corporate partners to find your Product / Market Fit

- Access to international markets through the Zone Startups and Barclays networks

- Dedicated access to onsite mentors and advisors

- Introductions to key industry experts

- $100,000 plus worth of cloud credits

- Residency in Rise Mumbai – a world class co-working space with state of the art facilities

- Opportunity to present to investors, industry experts and strategic partners at the Rise Accelerator Demo Day

Success stories 2016 – #GBGStories16

Announcing GBG Stories Search 2016, an exclusive opportunity for GBG Mumbai members to share their startup story and win a trip to Google’s head office at California.

- What inspired you to start-up?

- What is your startup doing? how is it helping customers

- What are the Google technologies you are using in your startup (APIs, Android, Maps, AdWords, Analytics, etc.,)

Sample case studies from 2014

- IA Project

- Parinita

- Safecity (final 10)

Event: Google #io16 recap on 4th June

This year at Google I/O, there were many firsts; This is Sundar Pichai’s first I/O after he moved up as CEO of Google, the location of I/O moved back to Shoreline Amphitheater which is literally the backyard of Googleplex at Mountain View, California. There was first for GBG Mumbai too, that members (Manan and I) were invited to host a GBG Summit and attend I/O.

There were many more firsts and tons of announcements, exciting new launches and hundreds of API releases. How does it all matter to you and your startup? Join us on 4th June as we do a recap from Google #IO16 and some key takeaways from Google Performance Summit that was held subsequently where new announcements about AdWords and Analytics were made.

Date & Time: June 4th, Saturday. 3pm to 5pm.

Location: Zone Startups, 18th Floor, BSE Building, Dalal Street.

Speakers: Manan Shah, Sreeraman Thiagarajan and Dhananjay Pandit

Entry: Free. Register here

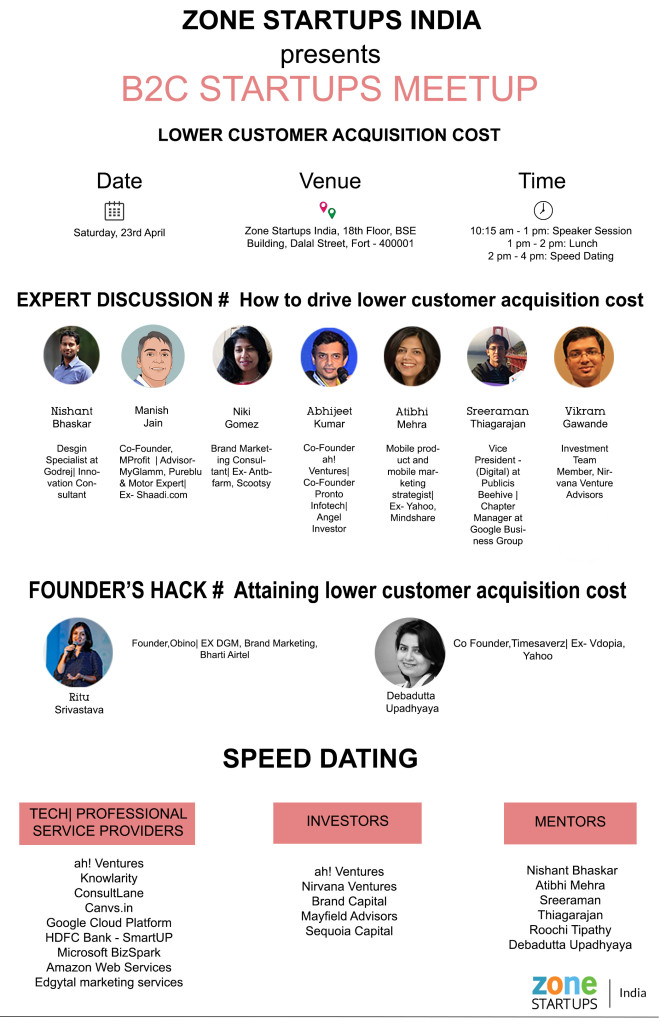

EVENT – Customer acquisition for B2C Startups – April 23rd

Zone Startups India is organizing a full day program, focusing on Customer acquisition for B2C Startups. This be a full day event, open for all B2C startups from Mumbai. The program includes a panel discussion on how to drive lower customer acquisition cost for B2C Startups by experts followed by founder’s hack on attaining lower CAC for B2C.

Mauka Mauka

We all were intrigued by the Mauka Mauka ads during the World Cup 2015 right? It was downright entertaining. Wasn’t it? But what was the message the ads were trying to show?

India has defeated Pakistan in all their world cup encounters till date. But there was hope, another encounter was scheduled – will it be Pakistan’s mauka to turn the tables. People in Pakistan wanted to give their national team another chance to prove that they can beat their arch rivals in the World Cup as well. Though they have not been successful till date, yet the citizens believed in them and the team does try their best to live up to their expectations. Though their campaign against India was unsuccessful, and they will have to return to try the same 4 years later – another chance?

In today’s modern digital friendly world, when everything is at our finger tips, all the world’s app, world’s products and world’s services – we all want world class services; but are not willing to have the time, patience and spend the money for it. We want everything to be perfect and everything on our terms.

If the Food Panda delivery is a minute late, we tweet about it. If the flipkart has sent you stones in place of a mobile phone, we instagram it. If the ola cab charges a hiked rate, we facebook it. And then we have that million dollar line following it – ‘Will never use it again’, recommending all our friends as well to never use the app. Aren’t we all being just cynical about everything that goes minutely wrong with these startups?

A Vodafone overbilling, a little less mayo in your McD burger, a delayed flight take off – everything needs to be posted on social media right? I do that to at times, but is it the best approach always. Are we just being too critical, are we expecting perfection in everything? Agreed that we have paid for it and we expect the best service but are we so closed minded that we are not open to occasional lapses?

There have been instances of iPhone not working smoothly at times, windows crashing, cars breaking down – these have been around since years and are MNC’s. We don’t judge them based on one such rare instance, then why homegrown Indian startups. Even they’ll get there in a while from now. Give them your support not your curse.

At anytime you may check your FB or twitter timeline, you’ll find 9 negative comments and if you’re lucky – one positive experience. If we so openly share the bad experiences then we should also share the nice time we have had with them. But maybe we do not do them because they do not give us enough likes, shares, retweets or comments? So our posts are worth the news channel TRP’s eh?

And then the readers look at one side of the story and take a stand. Even as per Indian laws, a person is innocent till proven guilty. But in today’s world – social media becomes a 24/7 court where judgements are delivered based on what you hear and see and not what the reality is. We forget that every story has 3 sides – the side you read, the other side of the story and most importantly the right side.

Have we already forgotten the Amul milk fiasco a few months back? Anything for self publicity eh?

So I want to share some of the instances I have in recent times:

a) There have been instances of Make My Trip (MMT) spoiling a person’s vacation. I use MMT very frequently. There have been instances when I have booked a hotel and later been informed that the hotel is sold out for the day. MMT has gone out and found alternative arrangements on an immediate basis and even upgraded me on the spot without leaving me stranded without shelling out an additional buck. And that was once in using them multiple times over the past few months.

b) People crib about Ola overcharging them and minting money by cheating them and stuff. I am an Ola fan. I have had a couple bad instances wherein the driver has refused or maybe charged for a trip not taken. But the response from the Ola team is immediate. Another cab is arranged, the money immediately refunded to my Ola money account.

c) I recently ordered from HolaChef and inspite of making the payment the order was apparently not processed and hence not delivered. I called and tweeted to them about it. And they immediately swung into action to have the order delivered or money refunded.

What we forget is that all these are aggregators. They do not hold or control the inventory. They are influencers. Some of the vendors on board realize the value and potential and adhere to the policies – some of them don’t. They put in a lot of effort to standarise all these services to improve our experience and sometimes fuck ups do happen which many a times would not be their fault – it is the vendor on board who has messed it up. Yes, as a brand, being the initial point of contact they are responsible for the best in class services and they do strive to do them. While at work haven’t we also fucked up at times only to be covered by a colleague and improved and been extra cautious from next time onwards?

Don’t judge them based on one bad experience. If they’re willing to learn from their mistakes, they apologize, take corrective actions, and help make it up to you – Give them another chance. They deserve it. These startups are here to serve you to make your life better. They are not there because they enjoy fucking around with you. Shit happens.

Applaud them when they work hard to ease your daily life chores. Hasn’t Ola and Uber made commuting within the city easier without being fleeced by the local cabbies? Hasn’t MMT and Ibibo made travel lot more easier without bargaining with the local travel agent? Hasn’t foodpanda and tinyowl brought all the delicacies from your area to your home without having dozens of menucards?

Can we all just share our feedback with them and help them improve to a world class service. It’s their aim to be there and we can play a small role in helping them get there. We forget that it is the survival of the fittest and if they tread the wrong path they’ll be down the roller coaster ride even before you can blink your eyes. We all know the number of startups that shut shop every day.

Give them another ‘Mauka’. We can atleast do that much for them. Can we not?

[If you have a story to share, feel free to reach out to Team GBG Mumbai or you can mail me at [email protected]]

Originally posted on SimplySoch

You can follow me @simply_hardik

Hangout on Air with Google India for Google My Business – Sep 5th, 3:00 to 4:30 PM

Here’s a chance for GBG Mumbai members to interact with Google India over a Hangout on Air to know about ‘Google My Business‘

Ever wondered how Google is able to find a restaurant or a hotel near your place? Do you want to learn how can you get online presence like Samarkand, Bangalore (https://goo.gl/9Nmbkl) or help other businesses to get online without much efforts across all devices on Google Maps, Search and Google+.

Google My Business (https://www.google.co.in/

Why is Google My Business team doing this Hangout?

One of the mission of Google My Business is to educate merchants and users about the best practices to get the business online and make them aware about the policies which can lead to the suspension of a business from Google.

Agenda of the Hangout

-

Overview of Google My Business in India

-

Benefits of getting verified on Google My Business

-

Methodology to create and manage the business (even if you have multiple number of businesses)

-

Best Practices and Google My Business Policies with detailed case studies

-

Questions and Answers

How to join the Hangout?

Just click this link https://goo.gl/JZC8bC and click ‘Yes’ under the ‘Are you going to watch’

The idea is to spend bulk of the time on “Best Practices and Google My Business Policies with detailed case studies” section

Format and Date of the Hangout

-

Intended Audience: All members of GBG who would like to know about Google My Business.

-

Date: Saturday, September 5, 2015

-

Time: 3:00 – 4:30PM

-

Interactive hangout session followed by Questions and Answers

Questions Form:

You can submit your questions through the form below by Friday, September 4th, 2015

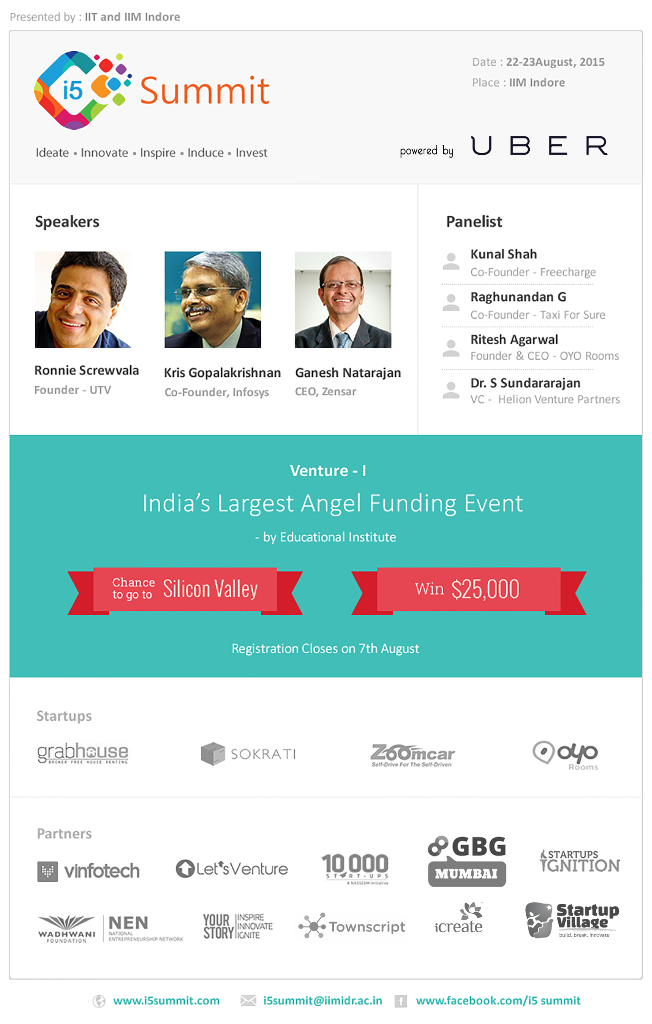

Angel Funding Opportunity – Aug 2015

Here’s your chance to Raise Angel Funding up to $25,000 in 10 minutes

During the summit, they have Venture-I which is the International Venture plan competition. It is a one of a kind platform where entrepreneurs can raise 15 lakh rupees of investment JUST by selling a minority stake(ie 5%) of their start-ups. It’s the fastest you will ever raise money- in just a ten minute duration (7 min pitch+ 3 min Q&A).

Want more? The Winner will also be inducted into NASSCOM 10k Startups’ Innotrek ‘2016 delegation to the Silicon Valley straightaway!

The platform is open to start ups that are less than 2 years old and have not raised more than 50 lacs rupees. If it is a business idea, the co-founders must have a full time team and a prototype.

Registrations for the Venture-I challenge have already begun and shall close on 7th August, 2015. Click here to signup http://bit.ly/venturei

EVENT: June 27th. Key learning from Google I/O and what that means for your startup

Google I/O 2015, one of the most coveted developer conference was held at San Francisco during the last week of May. I was fortunate to be there in person to attend the two day long, packed, fun and exhaustive series of sessions including the keynote talk.

A ton of new announcements were made including Android M preview, Brillo – an operating system for internet of things (IOT), Google Photos, Cardboard 2.0, Android Pay, etc.,

Back home, it is only fair as a chapter manager to pass on the learning to the entrepreneur and startups community, hence, a special event this weekend to interact with you all and share key information that may add value to your business.

We also have a guest speaker: Shashank Chinchli, who’ll give a detailed perspective about Android M and what it means to both, entrepreneurs and developers.

Do register and join us (entrey free) on Saturday, 27th June. 4pm to 6pm at

Thadomal Shahani Centre For Management (TSCFM),

Share the page with a friend, earn good karma 🙂

Interview with Mr. Samir Bhatia, CEO Smecorner

SMEs in India today contribute a large share to the economy. Not only that, but they also are responsible for 40% of India’s total exports. With an incredible growth story in the last decade or two, micro, small & medium businesses play a critical role in the growth of India.

For many SMEs though, the biggest problem is securing funding for their business. The existential gap between the people running these ventures and financial institutions is quite large. Aiming to reduce this gap is SMEcorner.com.

For many SMEs though, the biggest problem is securing funding for their business. The existential gap between the people running these ventures and financial institutions is quite large. Aiming to reduce this gap is SMEcorner.com.

Founded by Samir Bhatia, the Mumbai-based company is an online platform that enables SMEs to access loans easily from Banks and NBFCs. Under this platform, SMEcorner aims to minimize intermediary risk and extend transparency to the borrowing process, while assisting businesses in fulfilling their financial requirements. The online marketplace, SMEcorner has created gives SME’s easier, faster and more efficient access to resources that can help them grow, expand or finance a project.

We sat down with Samir Bhatia and discussed among other things, SMEs, his career, the budget and navigating through the Financial Crises of 2008.

Tell us a bit about your early life

I spent my early years in Mumbai, where I was born. After completing School & College, I went on to purse Chartered Accountancy and Cost Accountancy. During my Chartered Accountancy training, I chose to do a year of Internship with Citibank, which was a very good decision in terms of training and broadening perspective.

How was the experience at Citibank?

Citibank is a fantastic place to start one’s career. I got very good exposure to the best systems and processes and got plenty of opportunity to develop and implement new systems. I learnt from the best professionals and got a chance to travel the world to implement projects and systems developed by me.

You were also among the founders of HDFC Bank. What was it like to actually be a part of India’s biggest banks at a very early stage?

The feeling was one of tremendous joy and satisfaction. I was part of a passionate team of 6 individuals who did the early planning and strategy work for setting up the bank and also setting up the entire infrastructure, systems, processes etc. I thoroughly enjoyed it. We all joked that we were doing everything from “Janitor to CEO” in those days.

At HDFC Bank, you were a pivotal figure in the corporate banking division for 12 years, from 1994 to 2006. How did the banking landscape change during these years?

When we set up HDFC Bank, we brought in a totally new perspective to doing business – new products, new channels and faster decisions. Wholesale Banking was the mainstay of most banks way back in 1995 when we started business. Slowly over time, Consumer Banking asset products were introduced by banks and Credit cards also started getting popular. By the time I left the bank in 2006, Retail Lending was almost 45% of the business of the bank. Another big change in the Wholesale Banking side was the development of the SME business. Supply chain financing, which was pioneered and introduced by HDFC Bank, was a huge business.

How built up Barclays’ operations from the ground up in India, something you had experienced at HDFC. What similarities or differences were there between the two? And how did this experience contribute during the initial stage of SMECorner?

The experience of setting up HDFC Bank helped tremendously while setting up Barclays Bank. The difference, however, was that while HDFC Bank, being Indian, offered more freedom to define systems, process, products etc, Barclays Bank, being a MNC bank, was strongly governed by the policies and systems of the Head Office.

SMEcorner, which I my own venture, was a totally different experience; While the entrepreneurial skills which I picked up at HDFC Bank and Barclays Bank helped, the new venture was a totally different ball game being in the Digital world.

You were the head of Barclays’ India operations during the 2008 financial crisis. Can you comment on what it was like for you as CEO? (Bearing in mind that while India wasn’t hardest hit)

All the Banks in India who were aggressive in Consumer Lending took a big hit in the 2008 criris. The world changed overnight and the economic recession that followed made it very tough to recover money from borrowers. The crisis taught all the banks the importance of setting up a very strong Collections infrastructure even in good times. It was a difficult period but one that taught lessons no Business school could ever teach. Anyone who worked in that period can run the most difficult business now!

And now of course, you’re the founder & CEO of SMECorner.com. Where did the idea for starting a business like this originate?

Over the years when I was dealing with SMEs, I saw that they really struggled to get financing. They did not know which bank to approach and who to approach in those banks. They fell prey to middle men who would charge a hefty commission and not necessarily get them the best deal. So I thought it would be nice if there was an online platform where SMEs could apply for a loan and get transparent services without cost.

What kind of partnerships do banks and NBFC’s look for in SME’s?

Some of the parameters financial Institution look for is a good credit score of the applicant and the business, financial stability for past 2 years, nature of industry and the transaction history on the bank statement for the last one year.

Apart from that, the background of the promoters is also important. Here’s a question that a lot of entrepreneurs in India are asking – how do I ensure that my business get funding.

The first round of funding always comes from family and friends. Banks rarely fund startups and angels also look for some Proof of concept before they give money. So make a good business plan, get some initial funding from family and friends, do a proof of concept before going to Angels for finding. Crowd funding could also be an interesting platform to get funding.

Where do you think SME’s in India are heading?

SMEs in India are significantly upgrading their technology, product range, product quality, and are using the Internet to market and sell their products. The Ecommerce boom has provided a huge new opportunity for SMEs to expand their business and sell online. Easier availability of funding can further help SMEs to expand their business.

What are your thoughts on the budget?

There are many provisions in the budget to help the SMEs. In particular, the setting up of MUDRA bank will give a huge fillip to the SMEs in terms of faster and cheaper availability of finance. Infrastructure will also receive a boost which will further help ancillary industries and SMEs.

In a nearly three decade long career in the financial services industry, what is the most important lesson you’ve learned?

Invest In good people and build a good network of contacts in the community – personal and professional.

Business has changed. Since the liberalization of India’s economy in the early 90’s through multiple financial crises, how has the role of a senior executive changed and what lessons have you learned?

The world is now getting faster and product life cycles and economic cycles are shortening. The modern day company and hence the executive, has to be nimble and quick in adapting to change. The focus on technology is also high so the modern day senior executive has to keep himself/herself updated with the latest In the digital world. Also, the median age of the senior executive is now much lower than before.

And finally, any words of wisdom for students or professionals who want to excel in the world of finance?

Learning is a constant process and in today’s world, reading and learning and constantly upgrading ones knowledge and skills are critical. Also, every finance person should do a course in technology to understand that aspect as the world is turning Digital very very quickly.

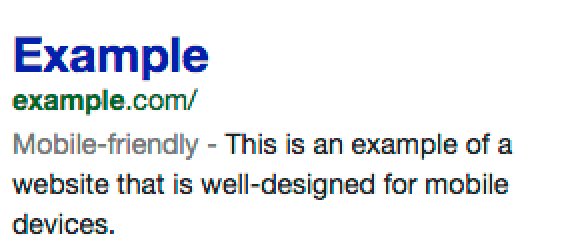

Search Ranking Changes by Google, What you have to do?

Google recently started displaying ‘Mobile Friendly ‘ on search results and this update means you have to optimize your website for easy access from mobile phones. See the announcement here

We recently received an update from Google’s search team about the entire roll-out process and it is called as #MobileMadness. Here’s a list of things for you to know more about the search ranking changes by Google and successfully make your website mobile friendly.

- See full schedule for #MobileMadness, Google’s month long campaign to help you prepare for the April 21 mobile-friendly ranking change.

- See if your site is mobile-friendly (http://goo.gl/YPb80C) and follow Google Webmaster to be a part of the#MobileMadness!

- Presentation for SMBs: Maximize your online strategy & search performance Focus on the right channel, Google Webmaster Tools (goo.gl/XQXGdw) and SEO as a long-term strategy http://goo.gl/lb1ASU

- 4-part series: Basics of a mobile website for SMBs

1 http://goo.gl/qpDvR7

2 http://goo.gl/dWHqQq

3 http://goo.gl/tQYS7w

4 http://goo.gl/6y7Twi - Live office hours for SMBs/SMEs Get 1:1 help for your website, Google Webmaster Tools (goo.gl/XQXGdw) and your Google Search presence. http://goo.gl/xr12ks

- Live Q&A session for the mobile-friendly ranking change Ask your questions here. http://goo.gl/VB9qPT

- 30 Day Challenge to go #mobilefriendly Are you in? http://goo.gl/pi7y3k

- Tips for going #mobilefriendly Fun polls every Friday

We Hope this helps you in better SEO efforts for your website. Do share this page (click on the twitter logo) and make the web a mobile friendly place. ![]()